Which Best Describes Why Taxes And Savings Are Considered Leakage Factors?

Which best describes why taxes and savings are considered leakage factors?. Which best describes why taxes and savings are considered leakage factors. Savings taxes and imports are leaked out of the main flow reducing the money available in the rest of the economy. It can have many forms.

Imported goods are one way this may happen transferring money earned in the country to another one. Exports are leakages in the circular flow of income. Households pay wages to businesses.

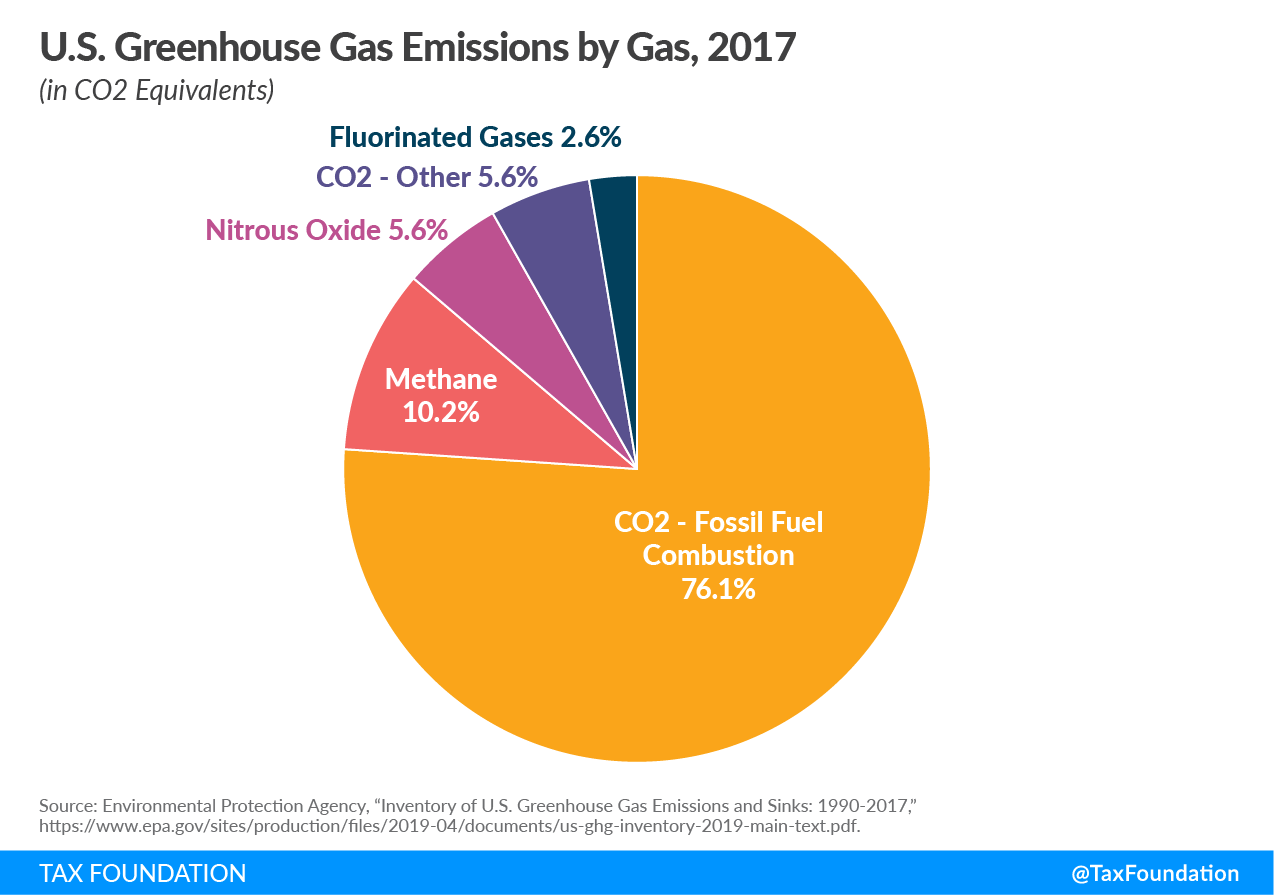

They take money out of the economic system. Taxes paid to the government have no direct effect on the economy. Interest rates are just one way for money to leak out of an economy.

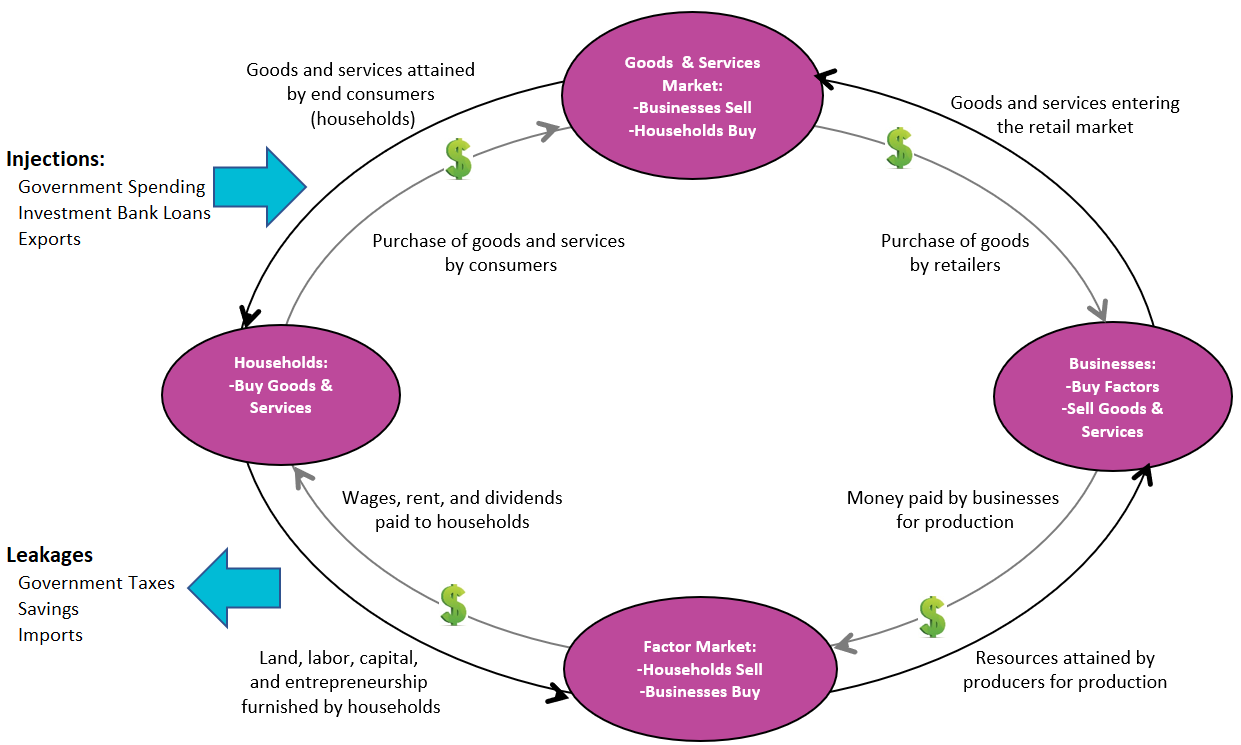

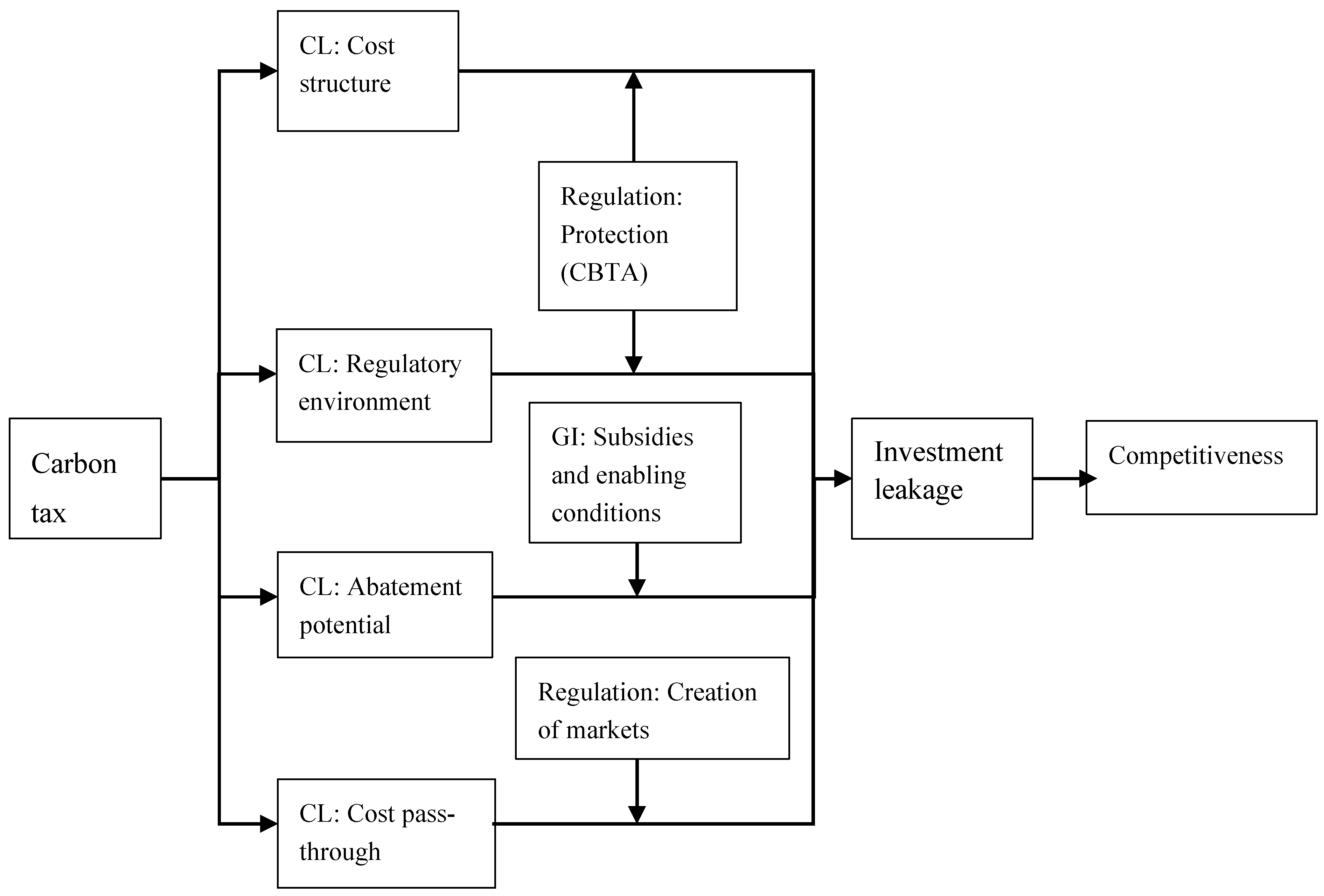

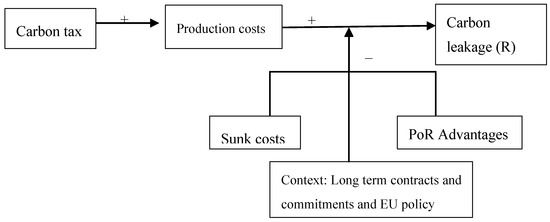

Leakage is usually used in relation to a particular depiction of the flow of income within a system referred to as the circular flow of income and expenditure in the Keynesian model of economics. Which best describes why taxes and savings are considered leakage factors. The model represents the interactions within sectors Which best describes why taxes and savings are considered leakage factors They take money out of the economic system THIS SET IS OFTEN IN FOLDERS WITH.

Why Leakage Matters in Economics. Which best describes why taxes and savings are considered leakage factors. There are injectors and leakages for instance Leakage occurs when income is removed by taxes savings and imports.

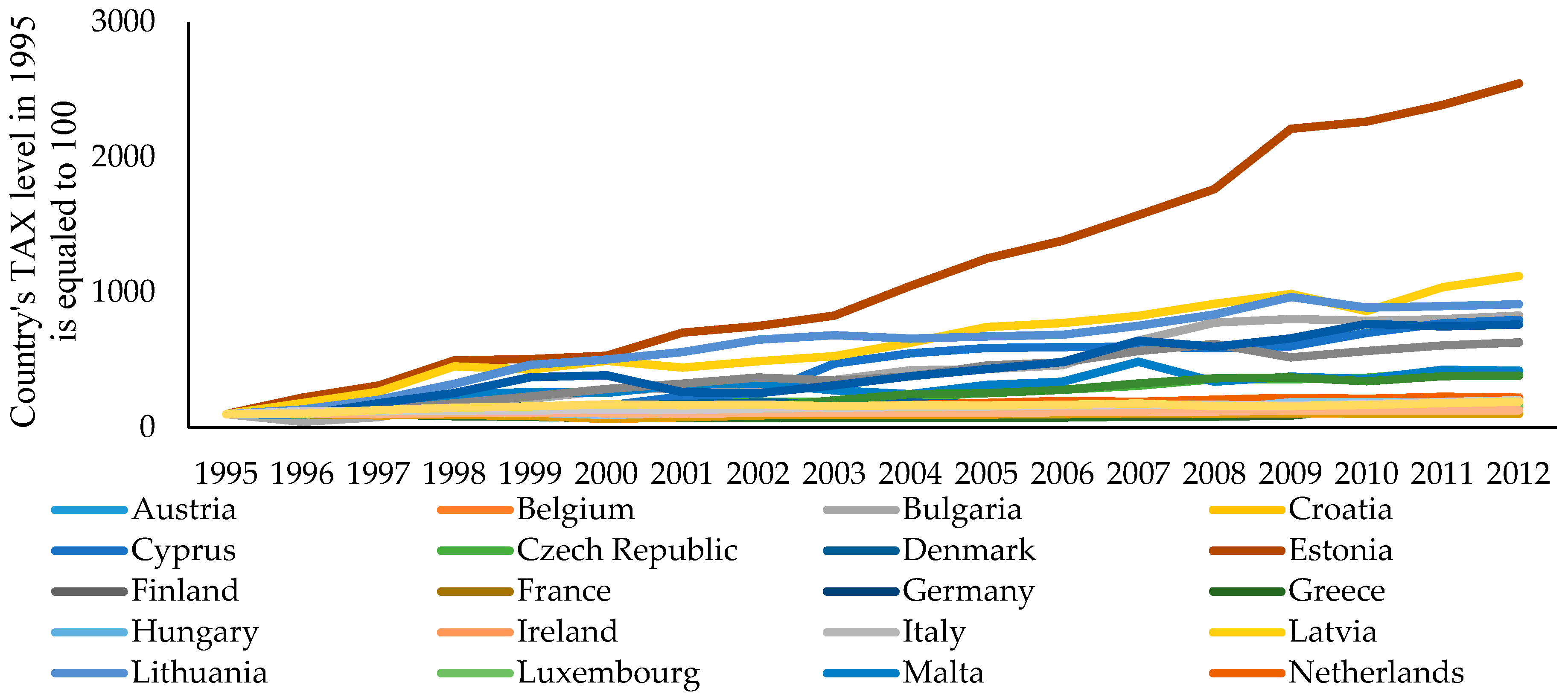

High taxes can have the same effect as can excessive saving or higher interest in purchasing. In microeconomics what occurs when equilibrium is reached. They take money out of the economic sectors.

Savings are a leakage in the circular flow of income. Since savings are the money we save so the money is not being used for consumption which means its not being injected.

The model is best viewed as a circular flow between national income output consumption and factor payments.

Savings are a leakage in the circular flow of income. In microeconomics what occurs when equilibrium is reached. It can have many forms. Because there are the spending or outflow factors. Why Leakage Matters in Economics. There are injectors and leakages for instance Leakage occurs when income is removed by taxes savings and imports. An employee savings plan ESP is an employer-provided tax-deferred account typically used to save for retirement such as a defined contribution plan. Analysis Report for Which Best Describes Why Taxes And Savings Are Considered Leakage Factors. What factors are considered when determining a countrys rate of natural increase.

They take money out of the economic system. They take money out of the economic system. Households pay wages to businesses. They take money out of the financial sector. Circular Flow of Economic Activity. There are injectors and leakages for instance Leakage occurs when income is removed by taxes savings and imports. Hence the term leakage factors is as if money leaked out of the economy momentarily in the case of savings and indefinitely in the case of taxes collected.

/GettyImages-1135477917-53b282ec4ef54ddf9639ceea3bfdca04.jpg)

Post a Comment for "Which Best Describes Why Taxes And Savings Are Considered Leakage Factors?"